September 30

Other

Understanding Third-Party Insurance Claims: When to File and When to Think Twice

What is Third-Party Insurance?

Third-party insurance, also known as “liability insurance,” provides coverage for damages or injuries caused by the policyholder to third parties.

A Third-Party Insurance Claim means you’re seeking compensation directly from the at-fault driver’s insurance company rather than going through your own insurer. While third-party claims can be an effective way to recover damages, they’re not always the best choice in every situation.

When Filing a Third-Party Insurance Claim is a Good Idea

- Clear Fault of the Other Driver: If the other driver is clearly at fault, and there’s strong evidence to support this (such as a police report, witness statements, or video footage), a third-party claim can be a straightforward way to recover damages without affecting your own insurance premiums.

- Significant Property Damage or Injuries: If the accident resulted in significant damage to your vehicle or serious injuries, a third-party claim can help ensure that you receive adequate compensation for your losses, including medical bills, lost wages, and property damage.

- Your Own Insurance Policy Limits are Low: If your insurance coverage has low policy limits or if you only carry liability insurance, a third-party claim can help you access additional funds from the at-fault driver’s policy to cover your expenses.

- The At-Fault Driver Has Sufficient Insurance: If the other driver has adequate insurance coverage, filing a third-party claim can help you recover the full amount of your damages without having to dip into your own coverage or savings.

When Filing a Third-Party Insurance Claim is a Bad Idea

- Disputed Fault: If there’s any question about who was at fault in the accident, filing a third-party claim could lead to delays or disputes with the other driver’s insurer.

- The Other Driver is Uninsured or Underinsured: If the at-fault driver doesn’t have insurance or has insufficient coverage to fully compensate you, a third-party claim may not result in full payment for your damages.

- You Need Quick Payment: Third-party claims can sometimes take longer to resolve than first-party claims (those filed with your own insurer). If you need quick payment for vehicle repairs or medical bills, it might be faster to file with your own insurer, who can then seek reimbursement from the at-fault driver’s insurer.

- Potential for Increased Premiums: While filing a third-party claim won’t directly affect your own insurance premiums, if your insurer becomes aware of the accident, they might still increase your rates, especially if there’s any doubt about fault.

Do laws vary state by state with third-party insurance claims?

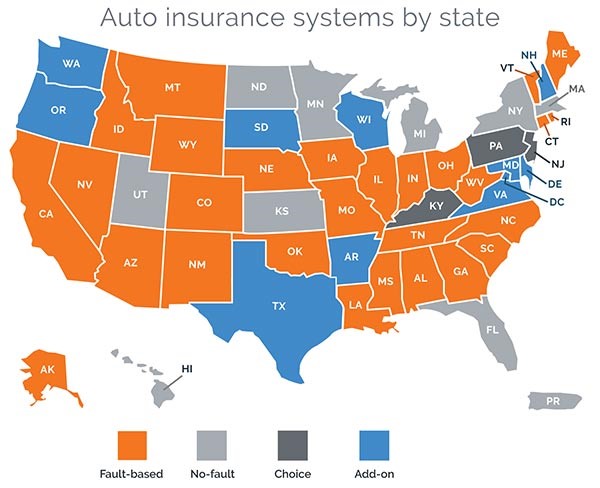

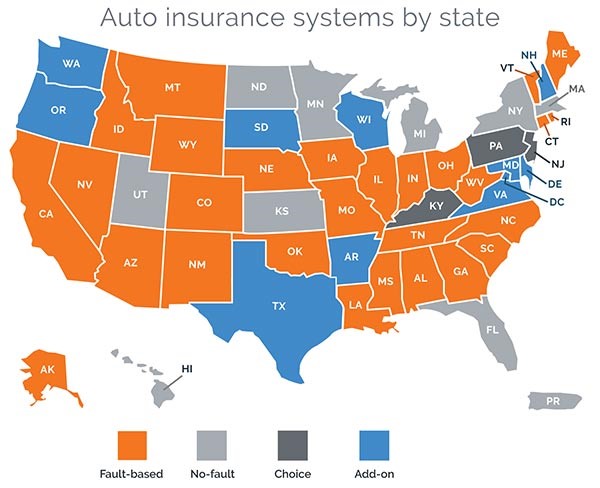

Yes, laws regarding third-party insurance claims can vary significantly from state-to- state. These variations can affect how claims are processed, the amount of compensation you can receive, and your rights as an insured party. Here is a map showing where state laws may differ:

- Fault vs. No-Fault States

- Fault States: In most states, the driver who is found to be at fault for an accident is responsible for paying the damages, typically through their insurance. This system supports third-party claims, where the injured party files a claim against the at-fault driver’s insurance.

- No-Fault States: In some states, known as no-fault states, each driver’s own insurance covers their injuries and damages regardless of who caused the accident.

Because of these state-to-state differences, it’s important to understand the specific laws in your state when considering a third-party insurance claim. If you’re unsure about the laws in your state, consulting with our firm can provide valuable guidance tailored to your situation.