July 26

The insurance impact of most driving violations can be more costly than the ticket itself. In some states, a speeding ticket can cost less than a tank of gas. Drivers cited for speeding, however, spend approximately $400 more a year on car insurance. Other traffic violations can cost you even more.

There are many factors beyond your control that determine insurance premiums – things like population, local crime rates, even the likelihood of certain types of natural disasters. But nothing impacts how much you spend on car insurance quite like getting a ticket.

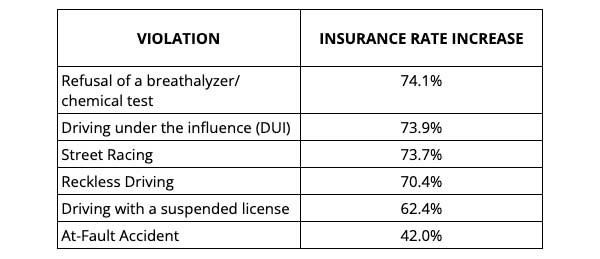

Here’s a look at some of the traffic violations that (on average) have the biggest impact on your car insurance rate.

Driver’s License Points

Driver’s license points are assigned to your driving record when you are convicted of a moving violation. The more serious the violation the greater the point penalty. Accumulating too many points in a certain time frame may cause your license to be suspended or even revoked.

The cumulative cost of points against your driving record can add up quickly, as these points typically stay on your record for three to five years, depending on where you live.

Each state’s points system is different; nine states do not use points at all (instead, these states look at a motorist’s unique driving record to determine if action should be taken due to repetitive bad driving). But even without a point system, traffic violations can increase your car insurance rates.

High-Risk Drivers

Auto insurance companies weigh many factors when determining if a driver is high-risk or not. When an insurance company considers you a high-risk driver, it will be harder to obtain insurance, especially at better rates. Drivers may be considered high risk because of multiple moving violations or a history of reckless or drunk driving.

Drivers can also face steep insurance increases for getting into car accidents. Rate increases following an accident depend on several factors including the severity and cost of the claim, your driving record, and who is found at fault for the accident.

Aside from a poor driving record, your financial and insurance histories may also influence whether you fall into the high-risk category. It’s been reported drivers with a coverage lapse see an 8% to 35% increase in their car insurance rate, depending on the length of the lapse.

Driving safely doesn’t just save lives, it is also a good way to save money on car insurance.